Whether you are a first-time buyer, an upgrader, or a property investor, knowing how the HDB schedule works matters a lot. It affects when to give up your current home, when to hold a wedding, when children can register for school, and how to handle loans and cash flow. One missed deadline can cost option fees or delay the move.

This guide walks through the full HDB transaction timeline for both new and resale flats—from the first HFE letter to key collection. You will see what happens at each stage, how long it usually takes, and what to prepare so the whole process feels orderly instead of chaotic.

ArchiProp Singapore focuses on breaking down property processes into simple, practical steps, with a bit of humor and plenty of real-world tips. By the end, the HDB timeline should feel clear and manageable, and it will be easier to plan life, money, and renovation around it.

Key Takeaways

The main ideas below give a quick overview before we dive into details. Keeping them in mind makes later sections easier to follow.

- The HDB timeline for new BTO or SBF flats usually spans about 2 to 5 years from application to key collection. It includes ballot results, flat booking, legal paperwork, and construction, so it suits buyers who can plan long term.

- The HDB timeline for resale flats is much faster, often 2 to 3 months from exercising the Option to Purchase to key collection. The search and negotiation phase can vary, but once HDB accepts the application, the rest follows a fairly standard pattern.

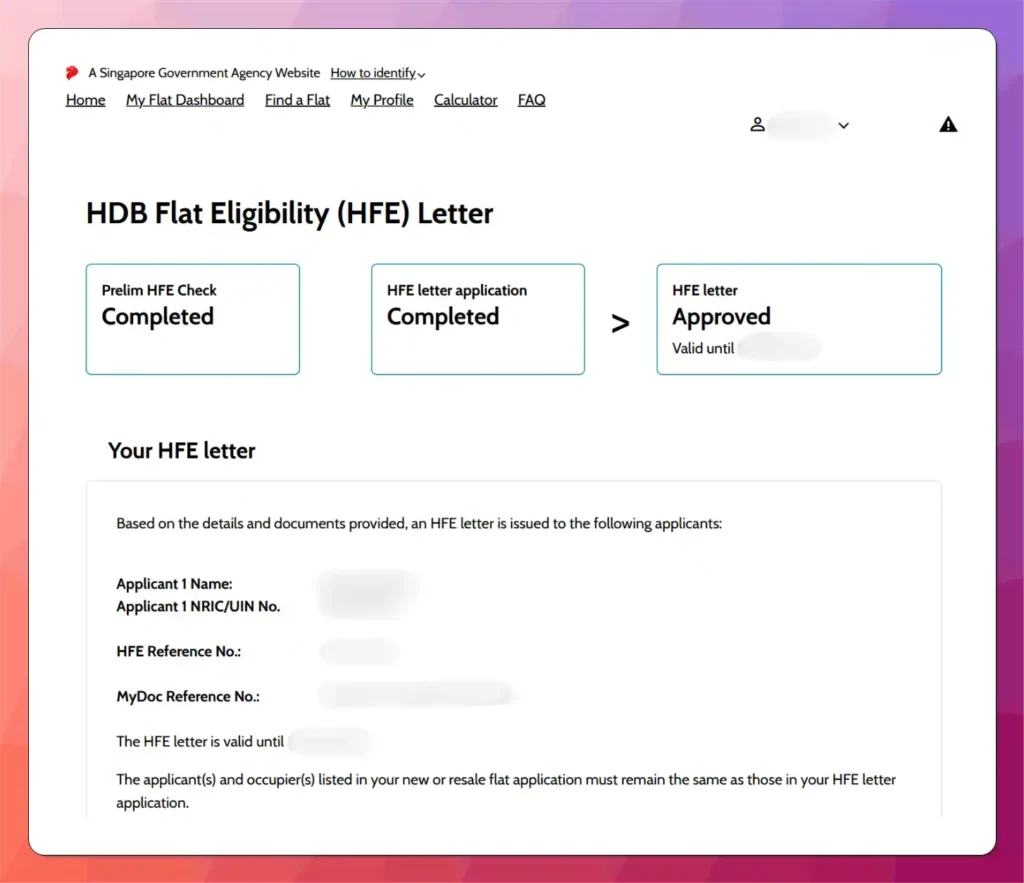

- Every HDB purchase now starts with the HDB Flat Eligibility (HFE) letter. Without it, buyers cannot apply for new flats or receive an Option to Purchase for resale units. Getting it early keeps the whole process from stalling at the start.

- For resale deals, the option period is 21 days, and completion is about 8 weeks after HDB accepts the resale application. Missing these key dates can delay the timeline or even cancel the deal, so tracking them carefully is just as important as preparing the money.

- Early financial planning, neat document preparation, and quick replies to HDB and banks help reduce delays. A clear view of the HDB timeline makes it easier to arrange moves, renovations, and school plans, turning guesswork into a controlled process.

What Is The HDB Transaction Timeline?

To a buyer, the HDB transaction timeline is the full sequence of steps from checking eligibility to collecting keys. It covers milestones such as grants, financing, legal checks, and handover. In simple terms, it shows how long it really takes before you can move into an HDB flat.

The timeline for a new flat (BTO/SBF) is very different from a resale flat. New flats often take 3 to 5 years before keys are ready because construction needs time. Resale flats usually complete within about 2 to 3 months once buyer and seller commit.

Understanding this timeline helps you:

- Ensure you have sufficient financial proceeds to make payment for your HDB purchase

- Plan where to live in the meantime

- Decide when to book movers and renovation contractors

- Coordinate school registration and major life events

HDB follows standard processes to protect both buyers and sellers, so certain parts of the HDB timeline cannot be rushed. There are fixed option periods, cooling-off rules, and processing times. ArchiProp Singapore turns these rules into clear guides so the process feels like a marked path instead of a guessing game.

Quick New vs Resale Comparison

| Flat Type | Main Phases (After HFE Letter) | Typical Duration* |

|---|---|---|

| New BTO/SBF | Ballot → Booking → Agreement for Lease → Construction → Keys | ~2–5 years |

| Resale | Option to Purchase → HDB Acceptance → Legal/Completion | ~2–3 months |

*Durations are approximate and depend on project, processing, and individual cases.

Getting Started: The Essential HFE Letter

Now, every buyer to a HDB transaction must obtain the HDB Flat Eligibility (HFE) letter. It is mandatory before:

- Applying for a BTO or SBF flat

- Receiving a valid Option to Purchase (OTP) for a resale flat

Without it, the rest of the process simply cannot move.

The HFE letter pulls together several checks in one place. It states:

- Whether you can buy a new or resale HDB flat

- What CPF housing grants you may receive

- The maximum HDB loan amount, if you choose an HDB loan

With this, buyers can see a realistic budget and avoid overstretching along the HDB timeline.

Applying for the HFE letter is done via the HDB Flat Portal using Singpass. Applicants submit:

- Personal and household details

- Income information and recent payslips

- CPF contribution history and any proof of other income or property

Processing often takes around a couple of weeks and is smoother when documents are complete and clear.

During the HFE application, buyers can also request an In-Principle Approval from participating banks if they prefer a bank loan. Having both the HFE letter and a bank indication ready makes it easier to proceed once the right flat appears. ArchiProp Singapore offers step-by-step content on eligibility rules and financial planning to help buyers prepare documents and avoid delays.

New HDB Flat Timeline: From Application to Keys

For buyers eyeing a BTO or SBF flat, the HDB timeline is a long game, usually 2 to 5 years. The wait can feel slow, but the steps themselves follow a clear order.

- Application During Sales Exercise

During a sales launch (usually open for about a week), applicants with a valid HFE letter choose preferred towns and flat types on the HDB Flat Portal. Submitting this application marks the official start of the new flat timeline. - Ballot And Queue Number

After the window closes, HDB runs a ballot and releases queue numbers, usually within about 2 months. A smaller number gives more choice of units and often an earlier booking appointment. - Flat Booking Appointment

Over the next few months, different groups attend flat booking appointments at HDB Hub. At this visit, buyers:- Select their flat from remaining units

- Pay an option fee (which goes towards the down payment)

- Confirm grant usage and basic financing

- Signing The Agreement For Lease

Within roughly 9 months of booking, buyers sign the Agreement for Lease. This is a major legal step and usually involves:- Paying the rest of the down payment

- Paying legal fees and stamp duties

- Confirming the housing loan in full

- Construction And Key Collection

Construction often takes 2 to 4 years from booking, depending on the project. HDB gives progress updates and estimated completion dates. When the block is ready, HDB invites buyers to a key collection appointment, where any remaining amounts are paid and ownership is granted.

During this waiting period, many buyers:

- Build up savings for renovation and furniture

- Track HDB updates on the project

- Plan layout, design, and renovation process in advance

Resale HDB Flat Timeline: A Faster Alternative

For those who cannot or do not want to wait years, a resale flat offers a much tighter HDB timeline. Once buyer and seller agree on price and terms, the whole process from Option to Purchase to key collection often fits within about 2 to 3 months.

- Viewings and Making an Offer

During this time, buyers are usually viewing units and comparing prices. - Option To Purchase (OTP)

Once both sides agree on price, the seller issues the OTP and collects an option fee. The buyer then has 21 calendar days to exercise it. In this window, buyers must:- Confirm financing with HDB or a bank

- Submit a Request for Value to HDB (if using CPF or a housing loan) by the next working day after receiving the OTP

- Submitting The Resale Application

After exercising the OTP, both buyer and seller submit their parts of the resale application via the HDB Flat Portal. They must do this within 7 days of each other. HDB then checks eligibility, documents, and details of the deal, which can take up to 28 working days. Once everything passes, HDB issues an acceptance of the application. - Legal Paperwork And Completion

Around 3 weeks after acceptance, HDB prepares legal documents for both parties to endorse online. At this stage:- Legal and administrative fees are paidFinal loan figures are confirmedThe completion appointment is scheduled, usually about 8 weeks from the acceptance date

Common delays in the resale HDB timeline come from:

- Missing or unclear documents

- Slow replies to HDB queries

- Last-minute loan issues

- Disagreements over valuation or Cash Over Valuation (COV)

Some sellers may also ask for a Temporary Extension of Stay (up to 3 months after completion). This must be agreed in writing and submitted as part of the resale documents. ArchiProp Singapore’s resale guides help both buyers and sellers understand these points so they can move through each phase with fewer surprises.

Strategies To Navigate Your HDB Timeline Smoothly

A clear HDB timeline is helpful, but knowing how to work with it is even better. A few habits can reduce stress for both buyers and sellers.

- For New Flat Buyers

Choose projects with estimated completion dates that match major life plans such as weddings or family planning. Keep saving regularly during the construction years so large payments and renovation costs do not come as a shock. Use this period to research renovation styles and stay tuned to ArchiProp Singapore’s design content, so decisions are quicker once keys are ready. - For Resale Buyers

Get the HFE letter and any bank pre-approval before serious viewing. Once you receive the OTP, submit the Request for Value quickly and send banks all required documents without delay. Respond fast to HDB messages and keep a simple checklist of tasks with dates instead of relying on memory. - For Sellers

If you want a faster sale, price your home based on recent transaction data in your block or nearby blocks. A realistic price attracts serious buyers and lowers the risk of high COV that scares buyers away. Prepare identity and ownership documents early and keep the flat presentable for viewings. A good agent can help handle viewings, paperwork, and buyer questions. - For Everyone

Open communication is the quiet hero of a smooth HDB transaction. Share your timing needs with agents, banks, and the other party early. Build a bit of buffer into moving and renovation plans in case dates shift slightly. ArchiProp Singapore supports this with clear education on HDB rules, market patterns, and post-purchase renovation planning.

Conclusion

The biggest difference in any HDB timeline lies in new versus resale flats. A BTO or SBF flat stretches across years because construction takes time, while a resale flat moves from commitment to keys in a matter of months. Both options can work well once the steps and deadlines are clear.

Good preparation turns the HDB timeline from a source of worry into a simple schedule to follow. Securing the HFE letter early, planning finances around each milestone, and tracking deadlines closely all reduce stress. Personal experiences may vary, but the overall structure is similar for most buyers and sellers.

With the right guidance, the HDB timeline does not need to feel confusing. ArchiProp Singapore offers guides on eligibility, grants, financing, market trends, and renovation so that each phase feels manageable. With clear information, anyone can make calm, confident decisions about their next home.